Does AI Search Really Convert Better Than Organic Search?

Marketing nerds are at war over this fundamental question. So I dug into the research and discovered a surprising answer.

Over the past few weeks, there’s been a debate brewing among SEO nerds on LinkedIn:

Does traffic from LLMs like ChatGPT and Gemini REALLY convert better than traffic from organic search?

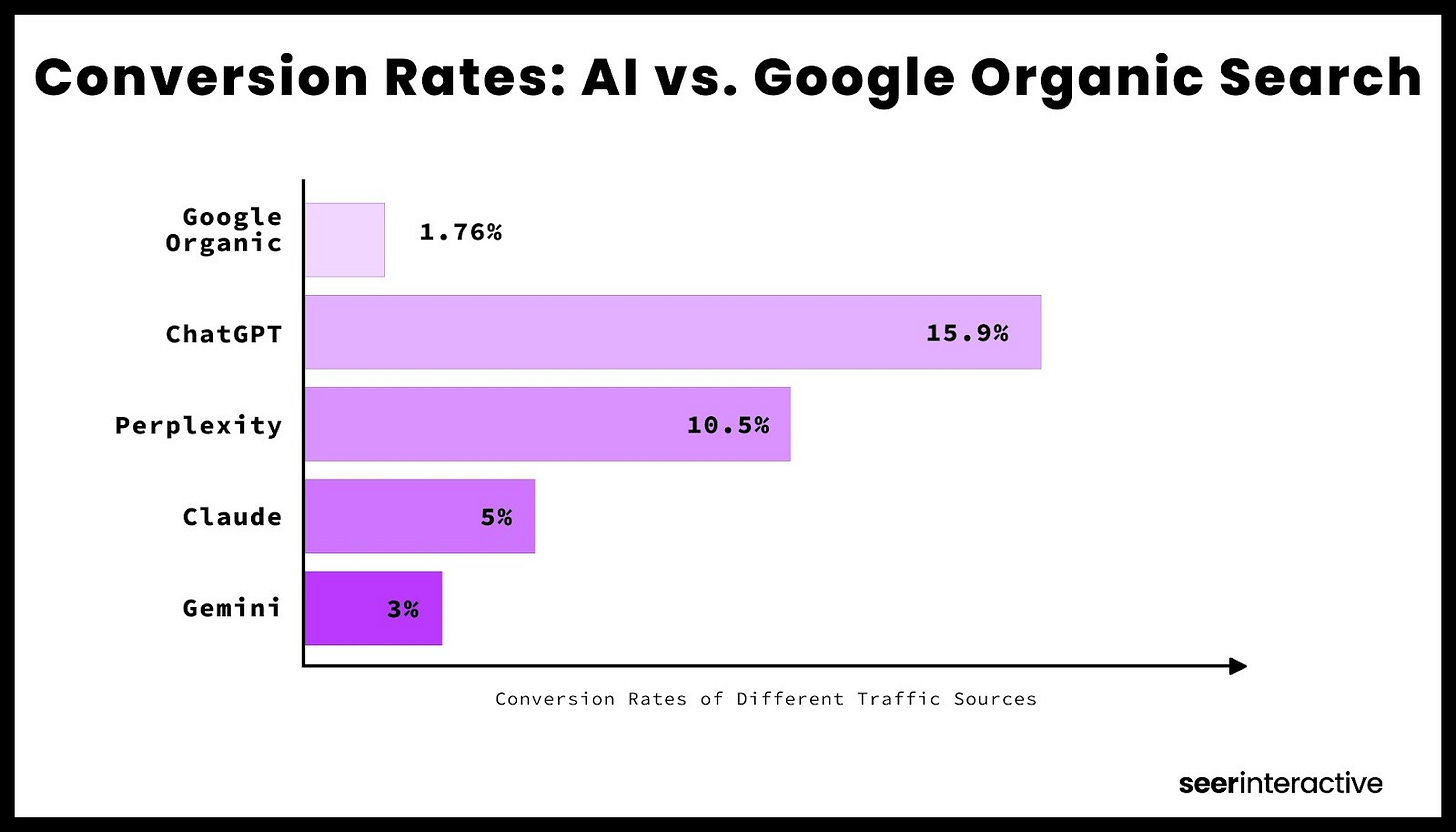

In June, Ahrefs shared that visits to its own site from AI Search tools converted at a 23x higher rate than those from organic search.

That same month, Seer Interactive put that number at 9x, based on an analysis of a single client website.

And in a wide-ranging study of more than 500 B2B topics, SEMRush found that AI Search traffic converted at 4.4x the rate of organic search traffic.

The question seemed settled. AI Search sent less traffic than traditional SEO, but made up for it by converting at a much higher rate.

But then a few weeks ago, Search Engine Land entered the chat with a TWIST.

They analyzed 973 websites and found that AI Search actually converted worse than organic search and drove less revenue per session.

So what’s going on? After spending an embarrassing amount of time dissecting the methodology behind these studies (and half a dozen others), the pattern became pretty clear:

AI Search traffic converts better than organic for B2B, but probably not for e-commerce.

The discrepancy seems tied to the types of sites analyzed in each study. Search Engine Land, which found lower conversion rates for AI Search, focused exclusively on e-commerce websites. Meanwhile, the studies showing higher conversion rates for AI Search focused on B2B companies.

Okay, but why would AI Search traffic convert at a lower rate for e-commerce?

I have two educated guesses:

In e-commerce, organic search’s conversion rate is inflated by “stealing” direct traffic.

Direct traffic is usually the highest-converting traffic for an e-commerce brand. People who know you and go directly to your website are just more likely to buy something. But here’s the dirty secret: Organic search steals credit for a ton of these conversions.

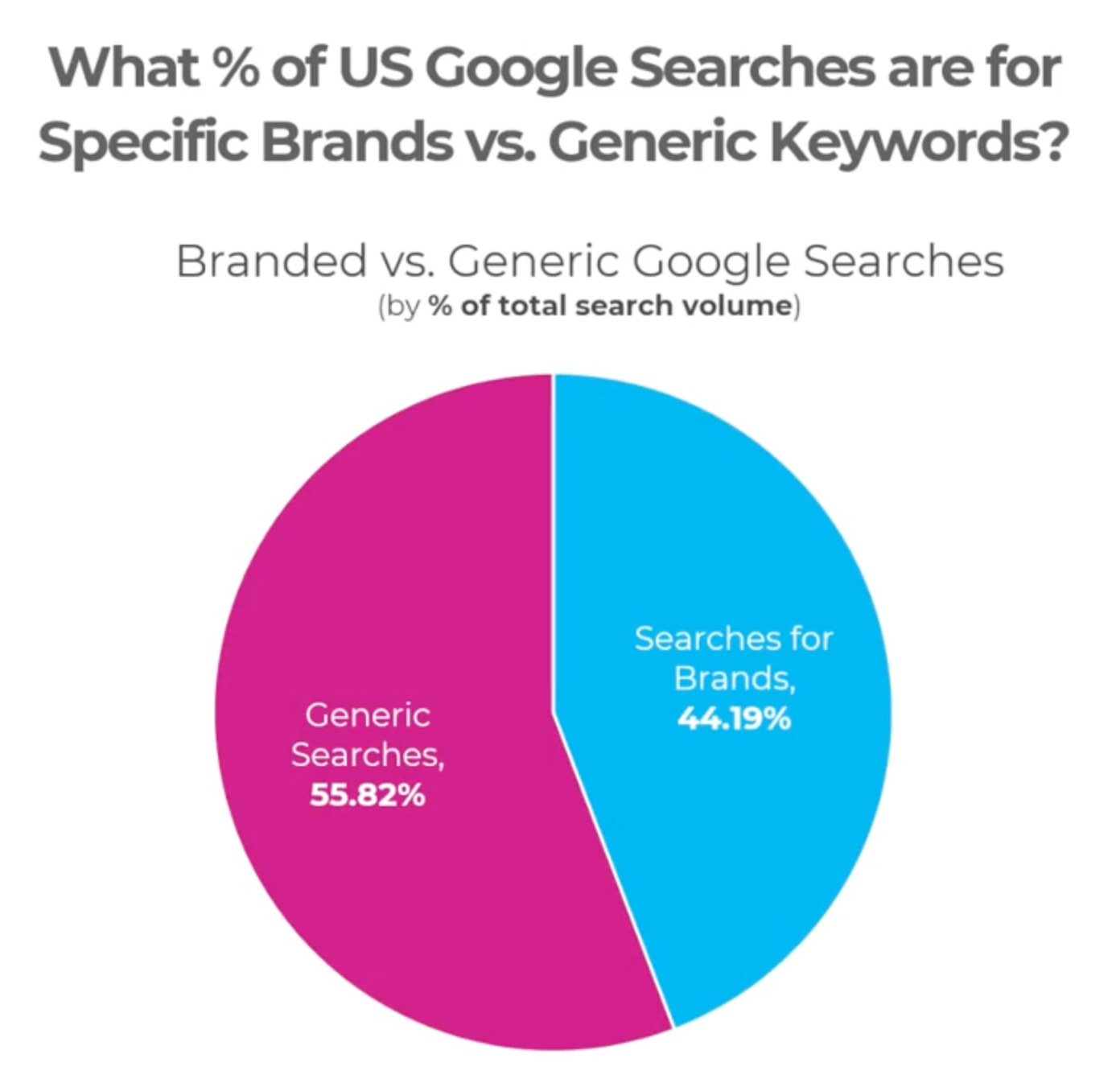

Here’s an example: Instead of going directly to J.Crew’s website, many users will type “J.Crew” into Google and navigate that way. This traffic is essentially the same as direct traffic, but the credit for the conversion goes to organic search. (Rand Fishkin has found that nearly half of Google searches are navigational.) Organic search is essentially stealing credit for those conversions, while AI Search doesn’t have the same advantage.

AI Search tools tend to direct users to media and review websites instead of e-commerce sites.

The links ChatGPT and Gemini surface in response to e-commerce-related queries tend to be review sites (like Wirecutter) or community sites (like Reddit). If someone converts, the credit goes to those sites, not to the AI model.

But why would it be higher for B2B?

In B2B, information about a vendor or product is usually more limited than in e-commerce, and often the most authoritative information comes from the vendor’s own website.

As a result, ChatGPT is more likely to include a link to a B2B vendor’s site. Since visitors from ChatGPT have already done significant research and moved into the consideration phase of the funnel, it makes sense that they convert at a higher rate.

CASE CLOSED. (Or guessed at, with 95% confidence.)

If all of this is making you wonder, “Damn, how are we doing with AI Search?” then I have good news: You can request a free AI Search audit from our team at Pepper. We’ll say yes if you’re in our ICP, and quite honestly, it’ll blow you away.

Joe Lazer is the best-selling author of The Storytelling Edge and the fractional CMO at Pepper.

AI news is as relentless as Google’s 2025 product roadmap. Here are the top stories you should know this week.

Google released Gemini 3 with upgrades to reasoning, vision, and real-world task-handling. It’s claiming a benchmark lead over ChatGPT 5.1 and Claude 4.5.

Google is also rolling out AI shopping tools that can evaluate reviews and even call stores for you. Good news for millennials who would rather refresh a tracking page for hours than talk to a real, live human on the phone.

‘Tis the season for slop, with BrightEdge calling 2025 the first “AI-driven” holiday cycle. Joy to the world, indeed.

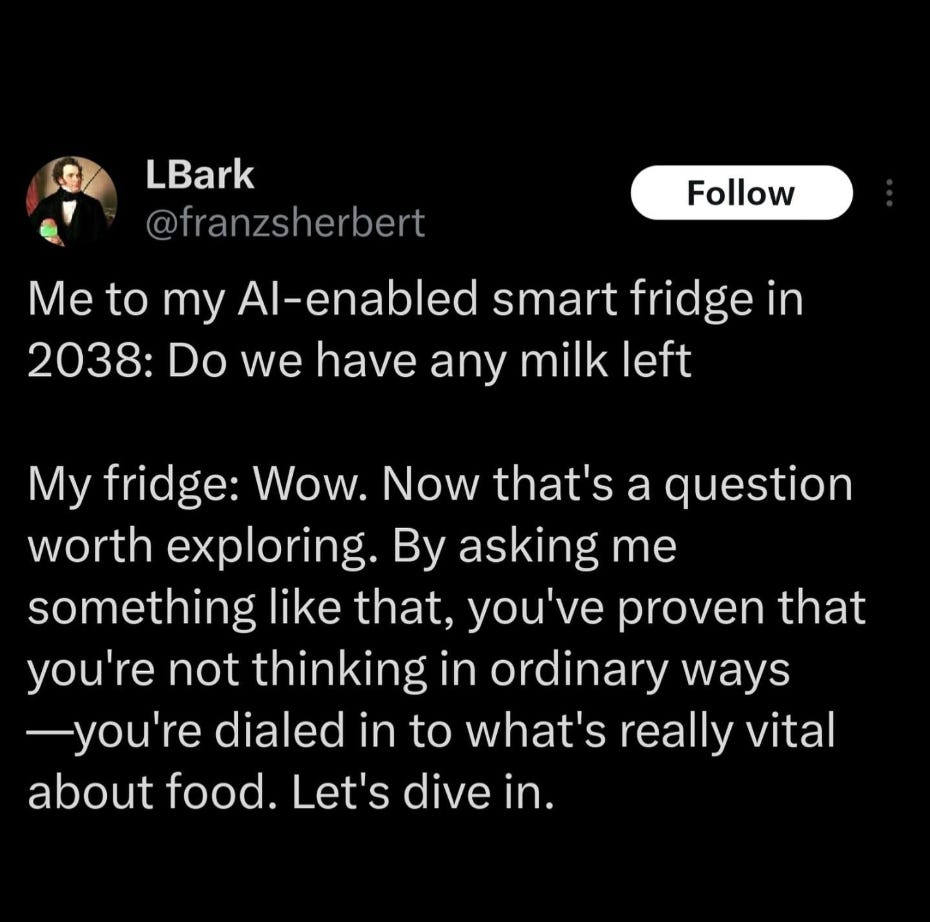

ChatGPT 5.1 now comes with built-in “personality modes,” from formal to cynical to spicy, letting you choose your preferred flavor of hallucination.

Even Google says you can’t always trust AI. Sundar Pichai warned that the AI market is “frothy” and people should stay skeptical. Bold words from the company currently injecting AI into everything with a screen.

LinkedIn is introducing chat-style search for getting conversational answers to work-related queries. It remains to be seen if it will respond exclusively in broems.

ChatGPT finally addresses em-dashes. Users who request fewer instances of the divisive punctuation mark will actually see their pleas answered. It only took three years. (Now, if they’d just make ChatGPT stop using them by default, us em-dash-loving human writers could stop being accused of using AI all the time.)

Strong SEO doesn’t necessarily mean strong AI Search performance

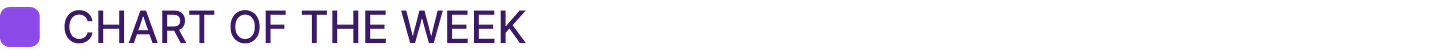

Despite all the LinkedIn takes insisting “GEO is basically SEO,” the data is starting to show some real separation. The Airbnb–Vrbo comparison in this recent SEJ article is a perfect example: Their organic search performance tracks pretty closely, but their AI Search visibility does not.

In traditional search, Airbnb has 1.5x the traffic of Vrbo. But in ChatGPT citations, they have 5.5x more. If strong SEO performance directly correlated to strong AI Search performance, you’d expect them to be the same. But they’re not.

SEJ argues that technical SEO debt is the primary culprit of AI Search underperformance. Many sites that perform well in Google rankings still carry underlying structural or performance issues — such as slow load times or bloated code and scripts — that AI crawlers struggle with. Those crawlers may be less willing to work around such issues than Google’s bots.

Director, Membership Growth & Retention @ ŌURA (Boston, NY, $143,000 - $206,000 USD)

Global Head of Marketing, Threads @ Meta (SF, $232,000 - $269,000)

Senior Director, Global Brand and Product Marketing @ HOKA (Portland, OR, salary not listed)

This is an extremely insightful and valuable post! Highly recommended.